-

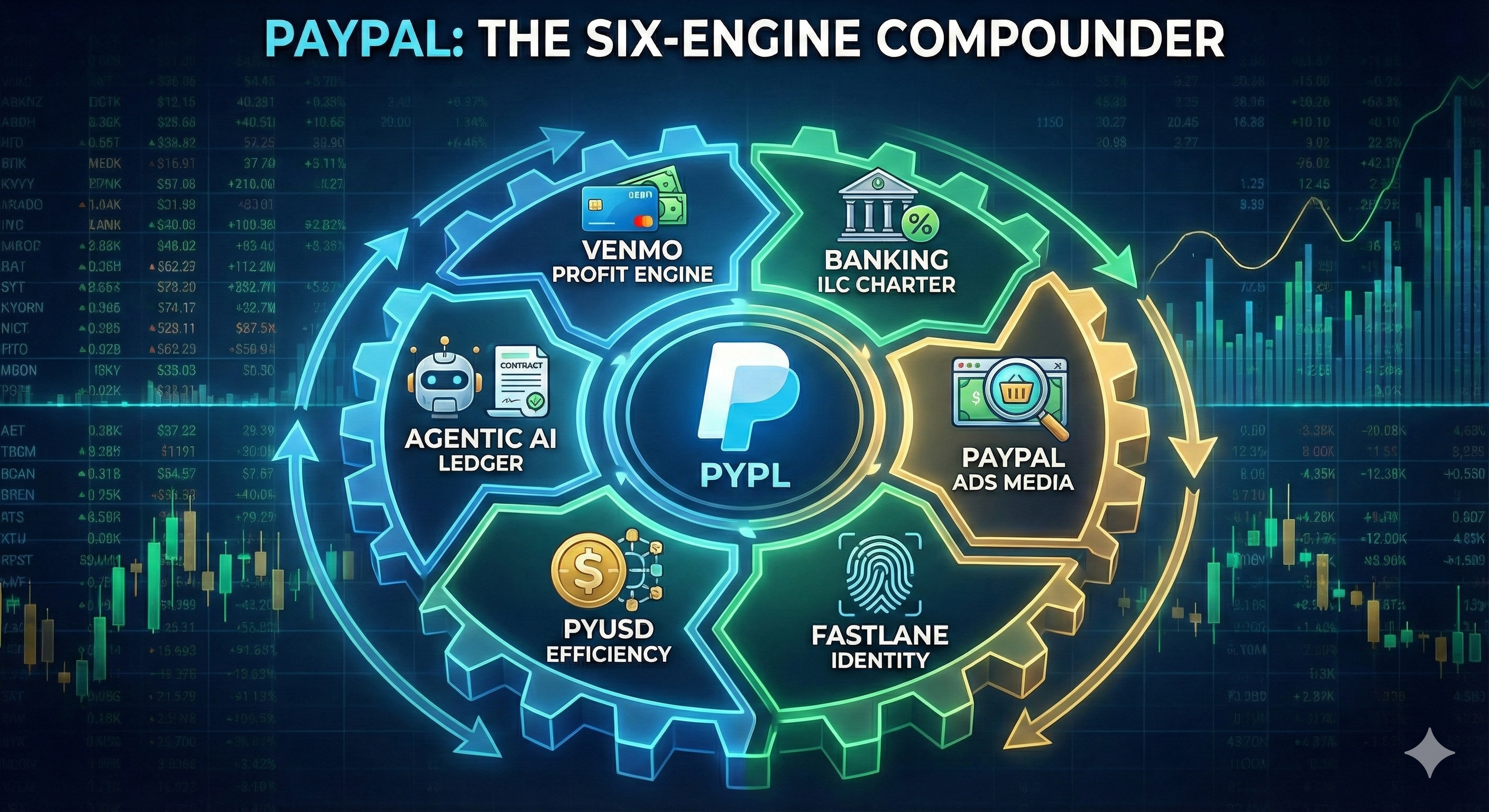

PayPal Holdings (PYPL) – The “Six-Engine” Compounder

We often get asked, “Why PayPal?” A valid retort to an investment that has moved nowhere in 4 years. In this article, we provide our thesis behind rating PayPal as a BUY and including it in the Plebdex for several years in a row. Investment Rating: CONVICTION BUY 12-Month Price… Read ⇢

-

Stonk Saturday: Google (GOOGL) — The Empire Strikes Back

We apologize for the delay in publishing this week’s Stonk Saturday. Consider it a Sunday special. We hope that folks had a nice Thanksgiving holiday with friends and family. If you’ve been bagholding Google for the last 18 months, I owe you a drink. Seriously. We watched NVIDIA buy a… Read ⇢

-

Watchlist Wednesday: Bitcoin Just Killed the 4-Year Cycle. Welcome to the Grown-Up Bull Market

Let’s rip the Band-Aid off fast: if the 26% dip has you fetal-positioned under your desk, you’re not investing. You’re doing emotional CrossFit. And you’re failing. Bitcoin has always been a mechanical bull soaked in tequila. That’s not changing. What’s changing is everyone pretending the ride is still controlled by… Read ⇢

-

Stonk Saturday: CoreWeave (CRWV)

If you want to know where we are in the AI infrastructure cycle and in the data center buildout, look no further than CoreWeave. This week, CoreWeave delivered its Q3 earnings report, and in it, we gained valuable insight. CoreWeave (CRWV) has quietly become one of the most important barometers… Read ⇢

Join our Community

Subscribe to Investing for Plebs and get smart, simple investing insights delivered straight to your inbox. No jargon, no paywall, no guru nonsense. Just real talk, charts, and the occasional meme about market meltdowns.

Your future self (and portfolio) will thank you.